Join 250+ InvestN TradingView Indicators Clients to

Help You Read the Market Like a Pro — Even if You’re a Beginner. No Coding. No Guesswork. Just Clear, High-Quality Signals.

Support & Resistance Zones

See where price is most likely to react — before it happens.

This indicator automatically detects the most important levels on the chart — where price has repeatedly bounced or reversed.

It’s perfect for planning trades, placing stop losses, or avoiding fakeouts.

- Adapts to new market conditions in real time

- Works across all timeframes — from scalping to swing trading

- Gives you confidence on where to enter, exit, or wait

- Highlights key price zones used by institutions and retail traders alike

Smart Money Concepts (ICT-Style)

Trade like the banks — not the crowd.

This advanced tool tracks institutional behavior by detecting break of structure (BOS), change of character (CHoCH), order blocks, and more. It gives you the same price action insights smart money uses — without needing to draw a single line.

- Automatically marks BOS, CHoCH, and liquidity grabs

- Spots valid bullish/bearish order blocks

- Helps you understand what side of the market big players are on

- Perfect for prop firm challenges, scalping, or precision entries

Fair Value Gaps + Liquidity Zones (Suggested 3rd Tool)

Catch where price is magnetized to — before the move even happens.

This tool finds imbalances in price action that often get filled, and highlights zones where stop hunts are likely. Combined with SMC, this creates insanely accurate sniper-level setups.

- Marks fair value gaps based on clean imbalance logic

- Identifies liquidity pools (equal highs/lows) — where price is likely to sweep

- Helps you avoid getting trapped in fakeouts or chasing entries

- Works beautifully with the Smart Money indicator for full narrative clarity

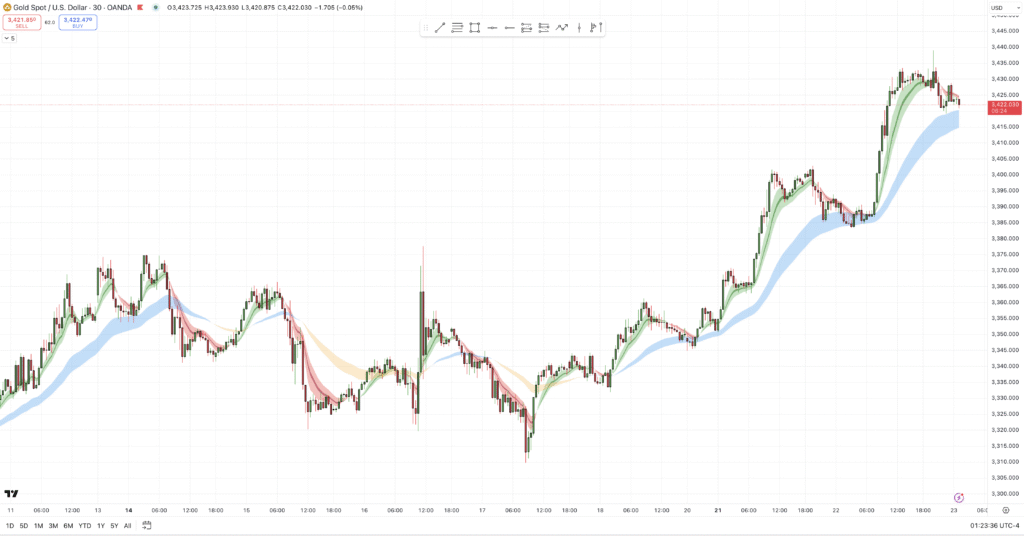

EMA Cloud – Precision in Motion

This visual tool cuts through market noise to reveal meaningful trends and actionable zones. The cloud’s boundaries act as dynamic support and resistance, helping traders stay aligned with momentum while managing entries and exits with precision. Whether intraday or swing trading, it adapts effortlessly across assets, making focus and decisiveness second nature.

- Clear Trend Identification

- Adaptive Support & Resistance

- Noise Reduction for Confident Trading

- Momentum-Aligned Execution

- Versatile Across Markets and Timeframes